The Bureau of Internal Revenue (BIR) continuously updates and revises tax laws, making it challenging for taxpayers to stay compliant and avoid costly penalties. Tax regulations can be complex especially for businesses and individuals with international dealings. Compliance with such regulations involving BIR Letter of Authority (LOA), Tax Residency, and Tax Treaty Relief is important for an efficient tax management.

Duran & Duran-Schulze Law specializes in Philippine Tax Law. We are committed to offer services that deal with tax compliances. With our invaluable expertise, we provide a comprehensive legal advice and offer assistance to ensure compliance with all regulations.

BIR Letter of Authority (LOA)

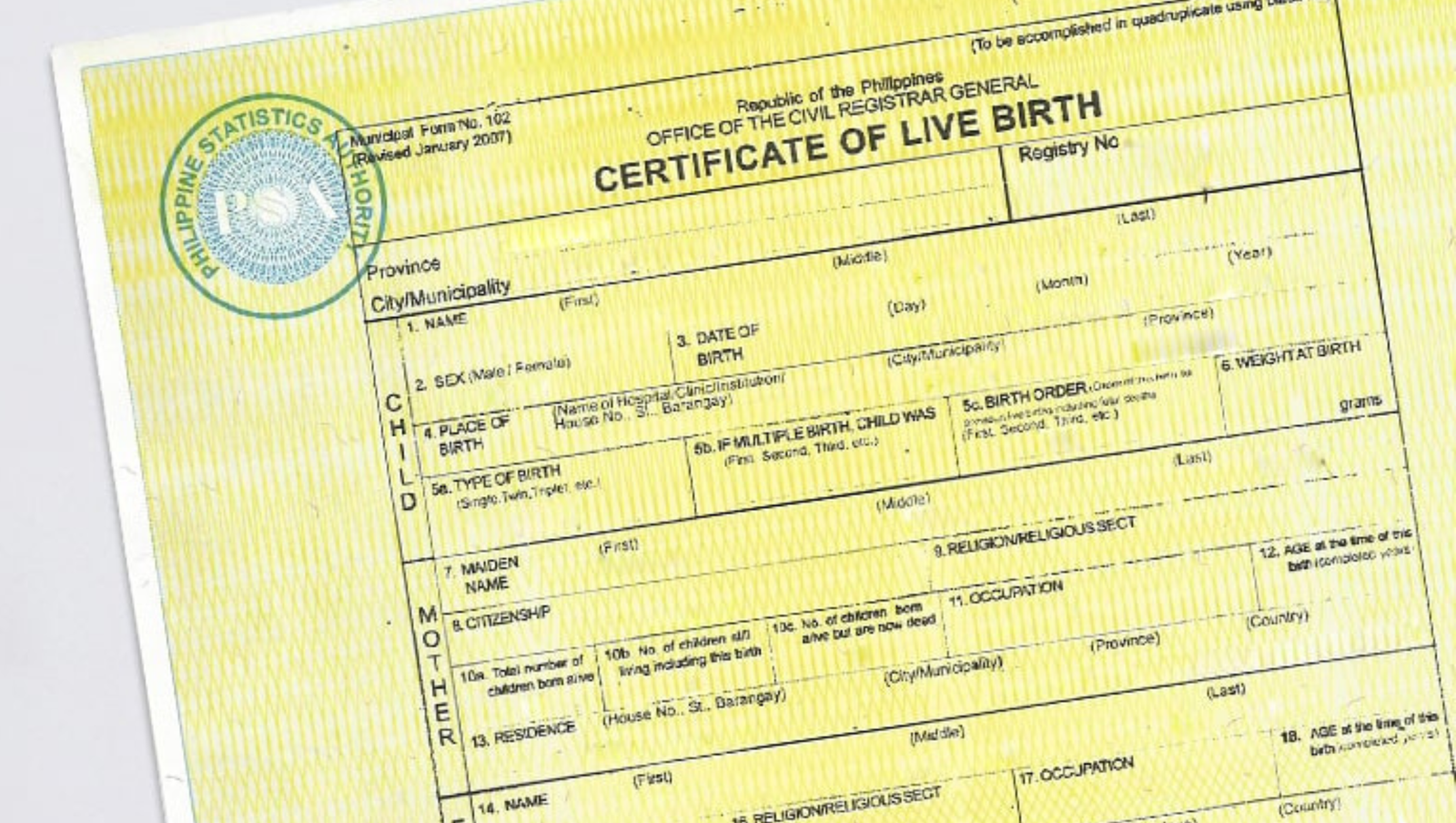

BIR Letter of Authority (LOA) is an official document issued by Bureau of Internal Revenue (BIR) to audit taxpayers. It allows BIR officers/examiners to assess the financial statement audit reports, book of accounts, and other accounting records. This process ensures if the taxpayer complies accordingly with tax laws, verifies the accuracy of financial records, and determines your tax liabilities for a particular year.

Tax Residency

The Philippines has entered into tax treaty agreements with other countries which primarily provides exemptions and/or preferential tax rates such as dividends, interest, royalties, profits of shipping and air transport in international traffic, and branch profit remittances on foreign-sourced income earned by a tax resident. This addresses the issues of being taxed twice on the same income. For a Philippine tax resident that is taxed worldwide, you must obtain a Tax Residency Certificate (TRC) to prove your residency. This document allows a foreign income payor to apply for reduced withholding tax rate or exemption to its payment to the Philippine income earner.

The International Tax Affairs and Division (ITAD) of the BIR is responsible for issuing this document.

Qualified Applicants

a. Resident citizen

b. Domestic Corporations

Take note that even though resident aliens and foreign corporations are considered as “residents” for domestic tax purposes, they are not qualified for a Philippine TRC because they are taxed only on the income from the Philippine sources.

Tax Treaty Relief

If the non-resident’s income was not subjected to tax in the Philippines in accordance with the relevant tax treaty, the non-resident or its authorized representative should file a Tax Treaty Relief Application. A Tax Treaty Relief Application (TTRA) is filed by a non-resident foreign corporation or individual whose income from Philippine intending to avail the preferential tax treatment under the tax treaties of the Philippines. This is being filed with the International Tax Affairs and Division (ITAD) of the BIR, subject to the Division’s inspection, review and approval.

STEP 1

STEP 2

STEP 3

STEP 4

Note that the consultation can be done either in person or online.

Duran & Duran-Schulze Law Can Help

Audit Review and Representation

Thorough review on financial records and provide comprehensive guidance throughout the audit process. We can represent clients during the BIR audit and investigation.

Compliance and Risk Management

Assist in application and ensure compliance with legal requirements in accordance with Philippine Tax Law.

Dispute Resolution

In cases of tax disputes or controversies, we can provide mediation, arbitration, or litigation services to resolve conflicts and achieve favorable outcomes for clients.