Duran & Duran-Schulze Law specializes in business and regulatory law, with expertise in interpreting PEZA regulations. We offer invaluable assistance with your registration and ensure your business complies with all PEZA eligibility requirements

Philippine Economic Zone Authority (PEZA)

Philippine Economic Zone Authority (PEZA) is a government agency under the Department of Trade and Industry (DTI). It is authorized to promote investments, provide assistance, register, offer incentives and facilitate the business operations of investors in export-oriented manufacturing and service facilities within the designated areas in the country that is recognized as PEZA Special Economic Zones by the President of the Philippines.

Incentives Offered by Philippine Economic Zone Authority (PEZA)

Registering your business with PEZA offers numerous benefits and opportunities. Depending on the location and industry priority, PEZA gives fiscal and non-fiscal incentives to registered business enterprises.

Fiscal Incentives Include

- For Export-Oriented Enterprises: Income Tax Holiday (ITH) of four (4) to seven (7) years and availment of Special Corporate Income Tax Holiday (SCIT) rate of 5% or Enhanced Deductions (ED) for ten (10) years.

- For Domestic Market Enterprises: Income Tax Holiday (ITH) of four (4) to seven (7) years and availment of Enhanced Deductions (ED) for five (5) years.

Non-fiscal Incentives Include

- Tax- and duty-free importation of capital equipment, raw materials, spare parts or accessories;

- Domestic sales allowance of up to 30% of total sales;

- VAT exemption on importation and VAT zero-rating on local purchases for goods and directly related to its registered activity to include telecommunications, power and water bills;

- Exemption from payment of national and local government taxes and fees for the period of availment of the 5% SCIT incentive;

- Employment of foreign nationals;

- Long-term land lease of up to 75 years; and

- Issuance of a two (2) PEZA Visa for foreign nationals employed by PEZA-registered companies and their dependents.

Duran & Duran-Schulze Law Can Help

Legal Advice

Our lawyers can identify potential problems that may arise during the registration process and can provide legal advice on how to resolve them.

Document Preparation

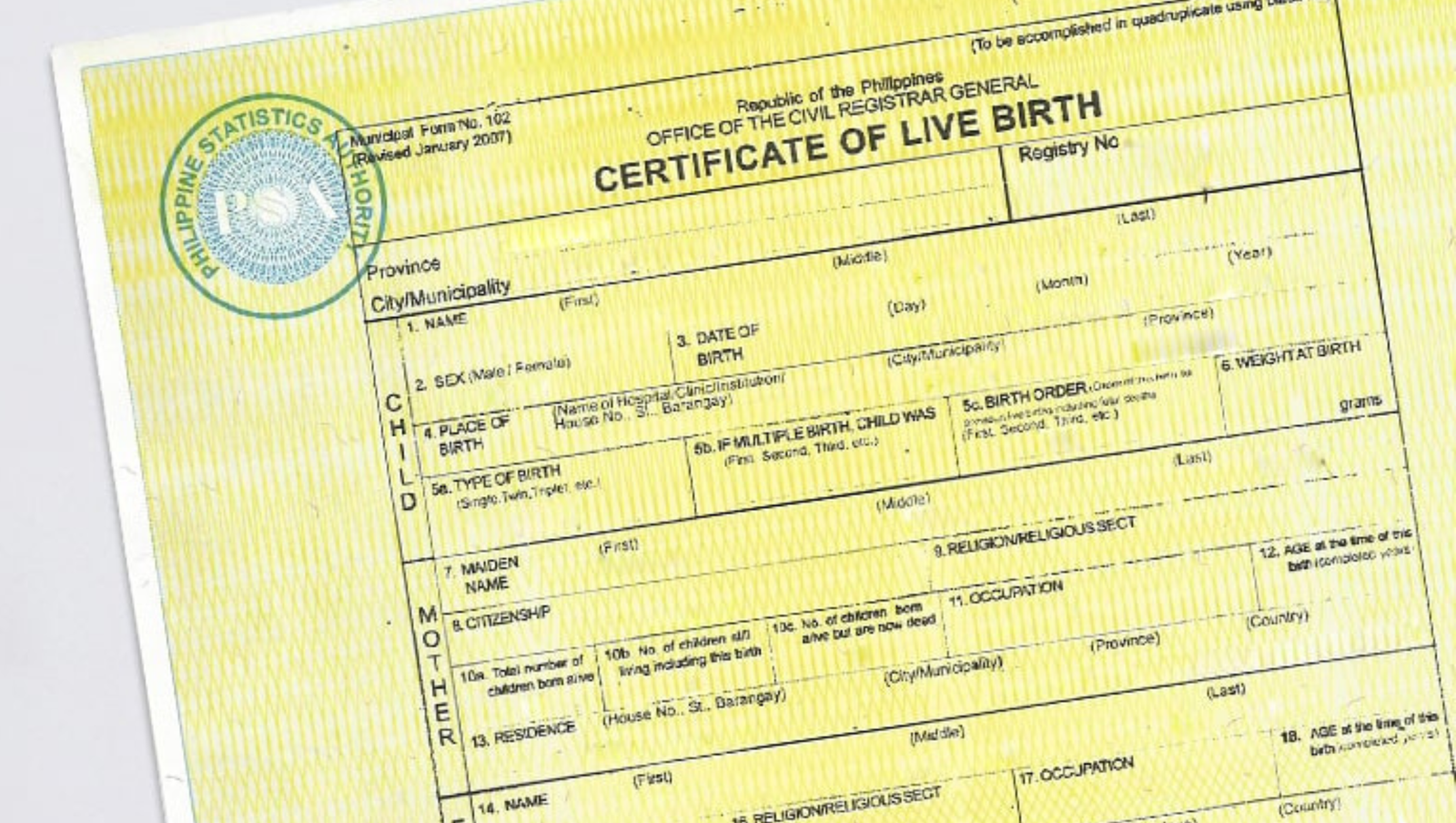

PEZA registration requires meticulous preparation of legal documents such as application forms, business permits, financial statements, and project proposals. At Duran & Duran-Schulze Law, we can assist you in preparing these documents without any difficulty.

Legal Representation

Our lawyers can act as your representative in handling queries, clarifications and any follow-up that you have with PEZA authorities. We are dedicated to ensuring your PEZA registration proceeds efficiently and successfully.