The Bureau of Internal Revenue issued on September 29, 2022 the Revenue Memorandum Order No. 43-2022 on Prescribing the Policies, Guidelines and Procedures in the Issuance and Use of Notice to Issue Receipt/Invoice (NIRI), pursuant to Revenue Regulations No. 10-2019.

What is the Notice to Issue Receipt or Invoice (NIRI)?

In the Revenue Memorandum Order, however, the Notice to Issue Receipt/Invoice (NIRI) is required to sellers, including online sellers to issue receipt or invoice for each service rendered and sale of goods.

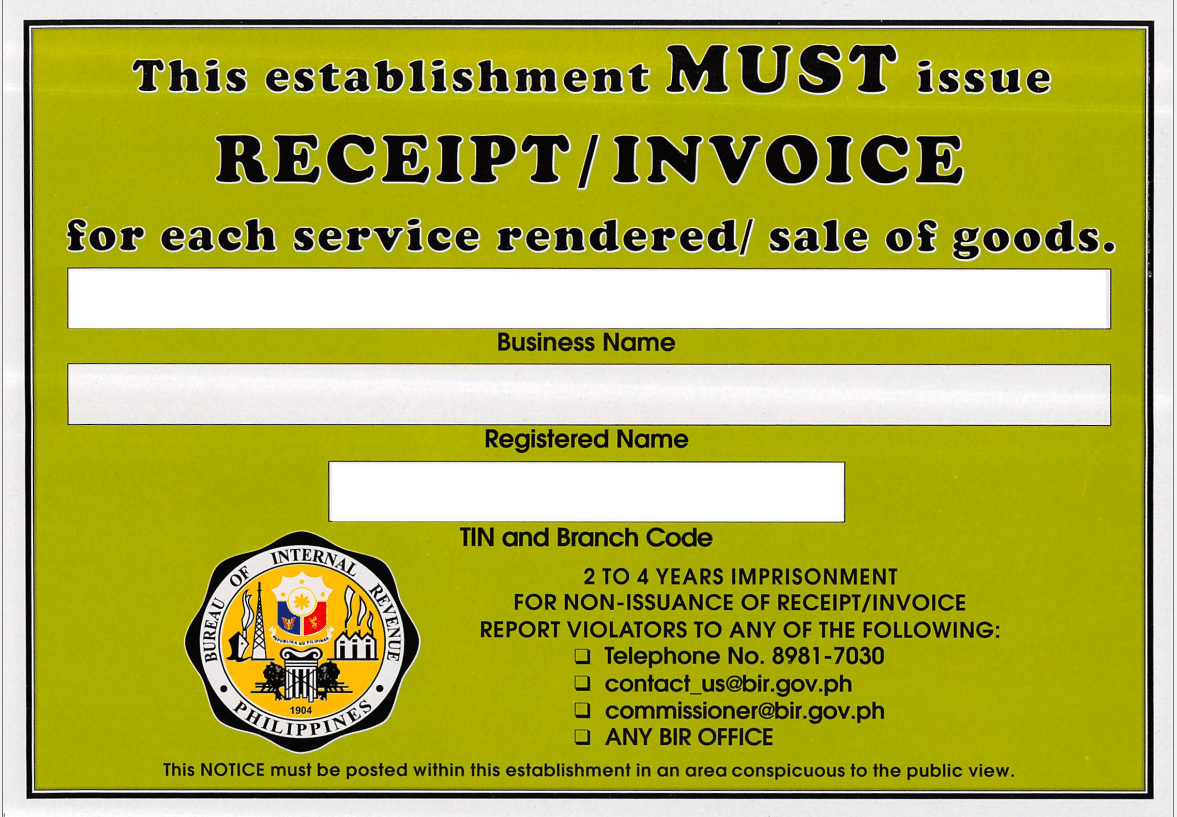

Revenue Regulation No. 10-2019 on the subject of Amending Pertinent Provision of Revenue Regulations (RR) No. 4-2000, as Amended by RR No. 7-2005, By Providing a New Format for the Notice to the Public to be Exhibited at Place of Business mentions that the BIR Notice to the Public shall be displayed prominently in places that can be seen by the public at the seller’s place of business.

Moreover, this include mobile stores, as well as branch stores. This revenue regulation issued shall be in line with the provisions of Section 244 in relations to Sections 237, 238, 264 and 265 of the National Internal Revenue Code, also known as the Tax Code, as amended to the Revenue Memorandum Circular No. 60-2020.

Who are Required to Issue Receipts or Invoices?

Stated further, the policies of the Revenue Memorandum Order indicates that it shall cover the following persons:

- New Business Registrants (NBR) head office and branches by the Revenue District office (RDO) where the taxpayer is registered.

- Online sellers and merchants, vloggers, social media influencers, online content creators earning income from the platform and/or advertising.

What Does a Notice to Issue Receipt or Invoice (NIRI) Look Like?

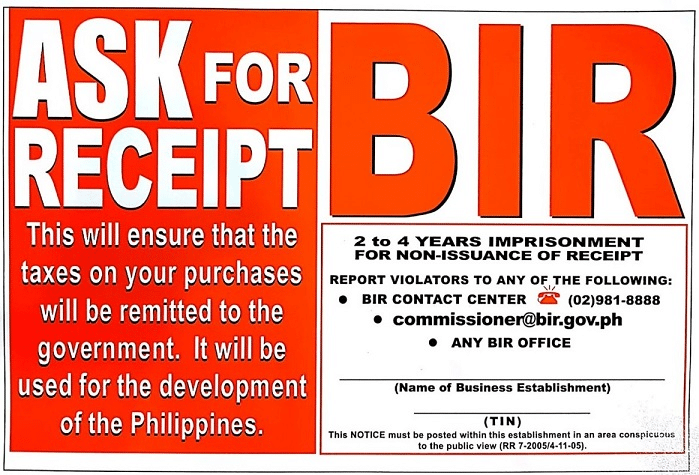

OLD VERSION

NEW VERSION

Note that the Revenue Memorandum Order also states that the “Ask for Receipt” Notice previously issued by the RDO/LT Division to registered business taxpayers based on RR No. 7-2005 shall still be valid until June 30, 2023, and it shall be replaced through staggered issuance of NIRI to the existing business registrants based on the ending digit of the Taxpayer Identification Number (TIN), to wit:

“TIN Ending Month

1 and 2 Beginning October 03, 2022

3 and 4 Beginning November 02, 2022

5 and 6 Beginning December 01, 2022

7 and 8 Beginning January 02, 2023

9 and 0 Beginning February 01, 2023.”

How to Replace the Old Issuance of the “Ask for Receipt” Notice?

To be able to replace the old issuance of the “Ask for Receipt” Notice, all registered business taxpayers are required to update the information of their registration. It is only after such an update that the Notice to Issue Receipt/Invoice (NIRI) shall be released. It is important that there must be a designated official company email address in the registration information as this shall be the primary means of communication of the Bureau of Internal Revenue (BIR) to be able to send letters, notices, orders, and the like.

Need further information and assistance regarding Notice to Issue Receipt or Invoice (NIRI)? Talk to our team at Duran & Duran-Schulze Law in BGC, Metro Manila, Philippines to know more about the requirements and process. Call us today at (+632) 8478 5826 or +63 917 194 0482, or send an email to info@duranschulze.com for more information.

2 Responses

Ask ko lang po yung collecting of garbage ba need pa humingi ng resibo if may collecting fees ang barangay?

To whom it may concern.

Hi!. This is regarding about the notice to issue receipt/ invoice.

May I know how to avail the said receipt.