Congratulations, you have taken the plunge in investing in the Philippines! As a foreign investor, should you want ease in securing the return of your investment in foreign currency, you will need to register your investment in the Philippines. This way, when your company declares a dividend, you will not have a hard time remitting funds from the Philippines to your country of origin. One of the things you should secure is a Bangko Sentral Registration Document (BSRD).

What is a Bangko Sentral Registration Document (BSRD)?

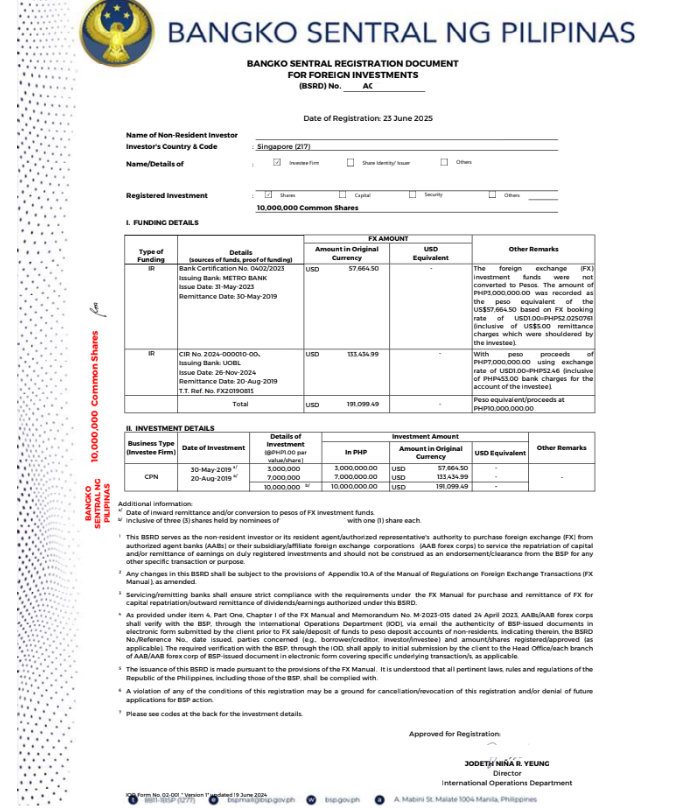

BSRD is a document evidencing registration of foreign investments and loans. The registration allows the transacting party to access the FX resources of, or purchase FX from, authorized agent banks (AAB) or AAB foreign corporations against Philippine Pesos for servicing/settlement of these transactions. (Manual of Regulations on Foreign Exchange Transactions (MorFEx). In simple terms, it is a document issued by Bangko Sentral ng Pilipinas (BSP) to allow non-resident investors to buy foreign exchange (FX) from the local banking system for the repatriation of their capital and remittance of earnings.

Who are Eligible to Apply for a Bangko Sentral Registration Document (BSRD)?

Any individual, corporation or juridical person (or through their authorized representatives) may apply. Once registered, non-resident investors will have access to the banking system for foreign currency requirements, and they will have a back-up source of foreign currency funds. The document will also aid the BSP in monitoring the capital flows of the country and optimal utilization of the foreign currency resources of the country.

When Should You Apply for a Bangko Sentral Registration Document (BSRD)?

The foreign investor should apply within one (1) year from the date of inward remittance of the foreign exchange funding the investment (for cash investments). Other funding includes those in kind (e.g., machinery and equipment, raw materials, supplies, spare parts and other items that are actually transferred to the Philippines, as well as intangible assets).

Note: Investments shall comply with all applicable laws, rules and regulations, including those issued by the BSP (e.g., prohibition against non-resident investments, whether directly or indirectly, in the BSP term deposit facility).

Where Should You File Your Application?

The application and supporting documents should be filed with the International Operations Department (IOD) located at Rm 301, 5-Storey Bldg. BSP Manila.

What are the Requirements for a Bangko Sentral Registration Document (BSRD)?

The cover letter, Application for Registration of Foreign Investments and other Supporting documents as indicated under Appendix 10.C of MorFEx are the required documents, and the following mentioned:

I. Proof of Funding

| Form of Funding | Proof of Funding |

| In cash | |

| Inward Remittance of Foreign Exchange (FX) | Certificate of Inward Remittance (CIR) of FX through an AAB in the prescribed format (Appendix 10.1), or equivalent document/s |

| Constructive Remittance of FX funding to a Resident’s Deposit Account (i.e., FX funding is credited to offshore account of resident investee/intended beneficiary/ onshore bank without actual inward remittance of FX but the investment is accordingly booked onshore in the records of the investee firm) |

|

| FX payments made offshore between non-residents for transfer of onshore investments | Proof of funding of initial onshore investment and subsequent FX payment made offshore for transfer of said investment to another non-resident –

|

| Peso balance of non-resident investor’s onshore peso deposit account and interim peso deposit account | Bank certification issued to non-resident investor by the depository bank attesting that the: (a) funding of the peso deposit account of the non-resident is in accordance with Section 3.1 of the FX Manual; and (b) the intended remittance of peso funds for the onshore investment |

| Reinvestment of Peso Divestment/ Sales Proceeds or Related Earnings of Investment | Proof of funding for the previous investment and proof of divestment/sale or earnings (as applicable) |

| For Divestment/Sales Proceeds |

|

| For Earnings |

|

| Conversion of Liability (e.g., foreign loan/bonds/notes/obligation) to Investment (e.g., equity) |

|

| Exercise of Conversion Rights to Underlying Shares [e.g., under Philippine Depository Receipts (PDRs)] |

(i) exercise by the non-resident PDR holder of his conversion rights; and (ii) the number of shares held by the non-resident investor arising from such exercise and that the same is within the ownership limit for non-resident investors under the Constitution of the Republic of the Philippines and existing laws of the Philippines in the case of PDRs. |

| In kind | |

| Heavy Equipment and Machinery/ Inventories/Raw Materials/ Supplies/Spare Parts/Furniture/ Personal Properties/Motor Vehicle/ Sea Vessel/Aircraft including other tangible assets from abroad |

|

| Intangible Assets [e.g., intellectual property rights (IPR)] |

|

| Stock and/or property dividends accruing from onshore investments | Proof of funding for existing investment and proof of declaration –

|

| Shares (e.g., share swap) | Onshore shares:

Offshore shares:

|

| Others not falling under Items A and B (e.g., stock splits/reverse stock splits, uplifted shares, investments made prior to 15 March 1973) |

|

II. Proof of Investment

| Type of Investment | Proof of Investment by Non-Resident Investor |

| Instruments for Registration with the BSP under Section 36 | |

| Assigned capital/operational working fund/contributed capital (Section 33.1.a) | For investee firms that are corporations:

For investee firms that are partnerships:

For investee firms that are sole proprietorships:

For joint ventures:

For investment in firms under dissolution or already dissolved: (i) SEC Certificate of Dissolution of the investee firm (as applicable); (ii) Statement of Net Assets in Liquidation signed by the Liquidation Trustee of the investee firm; and (iii) certification signed by the Liquidation Trustee of the investee firm attesting, among others, to the amount due to the non-resident investor and that no FX has been purchased in relation to such assets and/or amount. |

| Ownership or purchase of condominium unit (Section 33.1.b) |

|

| Capitalized expenses incurred by foreign firms (Section 33.1.c) | Government-approved service contract/other contract and Department of Energy (DOE)/ National Power Corporation (NPC) letter-validation of expenditures showing, among others, the distribution of validated expenditures among the partners under the service contract/other contract, or equivalent document |

| Equity securities issued onshore by residents that are not listed at an onshore exchange [Section 33.3.a.(i)] | For investee firms that are corporations:

For investee firms that are partnerships:

For investee firms that are sole proprietorships:

For joint ventures:

For investments prior to 15 March 1973 without Stock Transfer Agent’s Certificate:

For investment in firms under dissolution or already dissolved: (i) SEC Certificate of Dissolution of the investee firm (as applicable); (ii) Statement of Net Assets in Liquidation signed by the Liquidation Trustee of the investee firm; and (iii) certification signed by the Liquidation Trustee of the investee firm attesting, among others, to the amount due to the non-resident investor and that no FX has been purchased in relation to such assets and/or amount. |

| Debt securities issued onshore by private sector residents that are not listed at an onshore exchange and not covered by the provisions of Part Three, Chapter I of the FX Manual [Section 33.3.b.(i)] | Purchase invoice or subscription agreement, or equivalent document (e.g., promissory note) |

| Investment funds created onshore by residents, whether listed or not listed at an onshore exchange (Section 33.3.d) | Certificate of investment/proof of purchase/ acknowledgment receipt of payment issued by the issuer/seller, or equivalent document showing non-resident investor’s investment in said funds |

| Philippine Depository Receipts (PDRs) that are not listed at an onshore exchange [Section 33.3.e.(i)] | PDR instrument/certificate/subscription agreement/proof of sale or equivalent document showing non-resident investor’s investment in PDRs |

| Debt securities issued onshore by non-residents that are not listed at an onshore exchange (Section 34.2.a) | Purchase invoice or subscription agreement, or equivalent document |

| Instruments issued by residents and non-residents which are not covered by Sections 33, 34 and the provisions of Part Three, Chapter I of the FX Manual (Loans and Guarantees), and not contrary to applicable laws, rules and regulations (Section 35) | Document evidencing existence and purchase/ acquisition of onshore legitimate investments by non-residents, or equivalent document |

| Instruments under Section 36.1(a-g) used as collateral involving transfer of legal/beneficial ownership of the collateral to the non-resident investor | |

| Instruments for registration with AABs under Section 37 | |

| Debt securities issued onshore by the National Government and other public sector entities (Section 33.2) | Accredited dealer’s Confirmation of Sale (COS), or equivalent document |

| Equity securities issued onshore by residents that are listed at an onshore exchange [Section 33.3.a.(ii)] | Purchase invoice or subscription agreement, or equivalent document. For Investments prior to 15 March 1973: Stock Transfer Agent’s Certification that the investment was made prior to 15 March 1973 |

| Debt securities issued onshore by private sector residents that are listed at an onshore exchange and not covered by the provisions of Part Three, Chapter I of the FX Manual [Section 33.3.b.(ii)] | |

| Exchange Traded funds (ETFs) issued/created onshore by residents (Section 33.3.c) | |

| PDRs that are listed at an onshore exchange [Section 33.3.e.(ii)] | PDR instrument/certificate/subscription agreement/proof of sale or equivalent document showing non-resident investor’s investment in PDRs |

| Peso time deposits with an AAB with a maturity of at least 90 days (Section 33.4) | Bank certificate of peso time deposit |

| Equity securities issued onshore or offshore by non-residents that are listed at an onshore exchange (Section 34.1) | Purchase invoice or subscription agreement, stock certificate or equivalent document |

| Debt securities issued onshore by non-residents that are listed at an onshore exchange (Section 34.2.b) | |

| Instruments under Section 37.2(a-h) used as collateral involving transfer of legal/beneficial ownership of the collateral to the non-resident investor | Document evidencing existence and purchase/ acquisition of onshore legitimate investments by non-residents, or equivalent document |

How to Apply for a Bangko Sentral Registration Document (BSRD)

To apply for a BSRD, the applicant must follow these procedures:

1. Submission of Documents

The required documents must be submitted to the International Operations Department (IOD).

2. Evaluation of Application

The BSP-IOD will evaluate the application. Additional information and documents may also be requested from the applicant, if needed.

3. Issuance of BSRD

Once the application is complete and in order, a BSRD will be issued. The BSP-IOD will send a notice if the BSRD is ready for pick-up.

4. Claiming of BSRD

Once notified, the applicant may claim the BSRD at the releasing station of BSP-IOD.

Bangko Sentral Registration Document (BSRD)

Need further information and assistance regarding Bangko Sentral Registration Document (BSRD)? Talk to our team at Duran & Duran-Schulze Law to know more about the requirements and process. Call us today at (+632) 8478 5826 or +63 917 194 0482, or send an email to info@duranschulze.com for more information.